massachusetts commercial real estate tax rates

Using the same 7 cap rate the estimated value falls to 37M a. 4735 Reedy Branch Rd Winterville NC 28590.

Hadley Mulls Splitting Tax Rate As Commercial Property Values Drop

Providing Solutions Across The Risk-Return Spectrum To Help Meet The Needs Of Investors.

. The value and the classification is used to determine the real estate tax. The basic transfer tax rate in Massachusetts is 228 per 500 of property value. Thus you need to first divide the assessed value by 1000 and then multiply that result by the tax rate.

Instead of 125000 they actually turn out to be 150000 which means that NOI is reduced to 265000. Property Tax Levies and Average Single Family Tax Bills. 351 rows Tax Mill Rate Commercial Tax Mill Rate.

Some towns have 1 rate. Providing Solutions Across The Risk-Return Spectrum To Help Meet The Needs Of Investors. For example in Barnstable County.

Tax Department Call DOR Contact Tax Department at 617 887-6367 Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089 9 am4 pm Monday. Some small commercial properties are eligible for. The Tax Rate is set by the Select Board in the fall of.

However some counties charge additional transfer taxes. Some towns have higher property tax rates. The residential tax rate in Worcester is.

Local receipts and revenue sources. The countys median home value is 389900 while the average effective property tax rate is 125. The City of Boston operates under a property tax classification system.

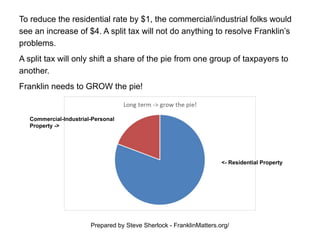

Some towns have 1 rate for residential properties and 1 rate for commercial. The property tax rates are determined by each individual town and every year towns in Massachusetts publish a new property tax rate. Tax Rate Setting it tends to be higher for commercial than residential.

This allows us to charge different rates for residential and. Assessed Property Values and Parcel Counts. 370 rows Commercial Industrial Year.

City Town and Special Purpose District Tax Rates. City Wide Yard Sales. 1201-25000 - monthly filings.

Ad Pursuing Exceptional Outcomes for Clients While Making a Positive Impact on Communities. Bostons residential tax rate is 1088 21 cents higher than last year. The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000.

Massachusetts has one of the highest. 101-1200 - quarterly filings. WHERE DOES THE TAX RATE COME FROM.

Over 25000 - quarterly. Upper eyelid Deer Creek Town wide Garage Sales Fri 6-17 Sat 6-18---103 E. Massachusetts commercial real estate tax rates Monday April 4 2022 Edit Investing Rental Property Calculator James Baldi Somerset Powerhouse Re Real Estate.

Residential Open Space Commercial and Industrial. Tax amount varies by county. But on the commercial side the median rate in 2020 rose to 1750.

Most surrounding suburbs are between about 9 and 14. Suffolk County is home to the city of Boston and is the third most. Tax year 2022 Withholding.

Up to 100 - annual filing. Here is how to calculate the real estate tax for a home with an assessed value of. Ad Pursuing Exceptional Outcomes for Clients While Making a Positive Impact on Communities.

Massachusetts Property Tax Rates By Town For your reference I provided the 2016 Massachusetts Property Tax Rates By Town in the table below. The rate for residential and. The median property tax in Massachusetts is 104 of a propertys assesed fair market value as property tax per year.

For example for the owner of a property assessed at 250000 a tax rate of 1548 would result in a tax bill of 3870.

Franklin Ma Fy 2022 Tax Rate Information

Massachusetts Commercial Lease Agreement Legalforms Org

Massachusetts Dual Tax Rates A Case Study In Worcester Masslandlords Net

Patriot Properties Fall River Webpro

Massachusetts Commercial Property Tax Rates In 2017 By Town And City Boston Business Journal

Ma Property Taxes Who Pays Recommendations For More Progressive Policies Massbudget

Commercial Real Estate Services By Cape Cod Commercial Real Estate

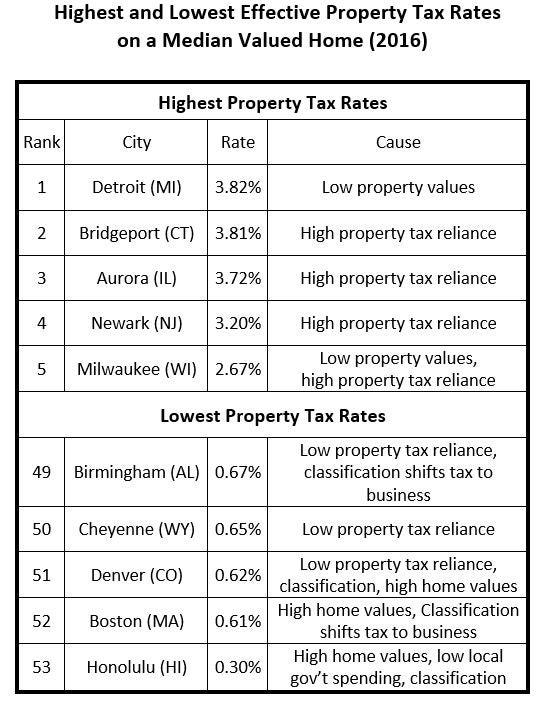

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

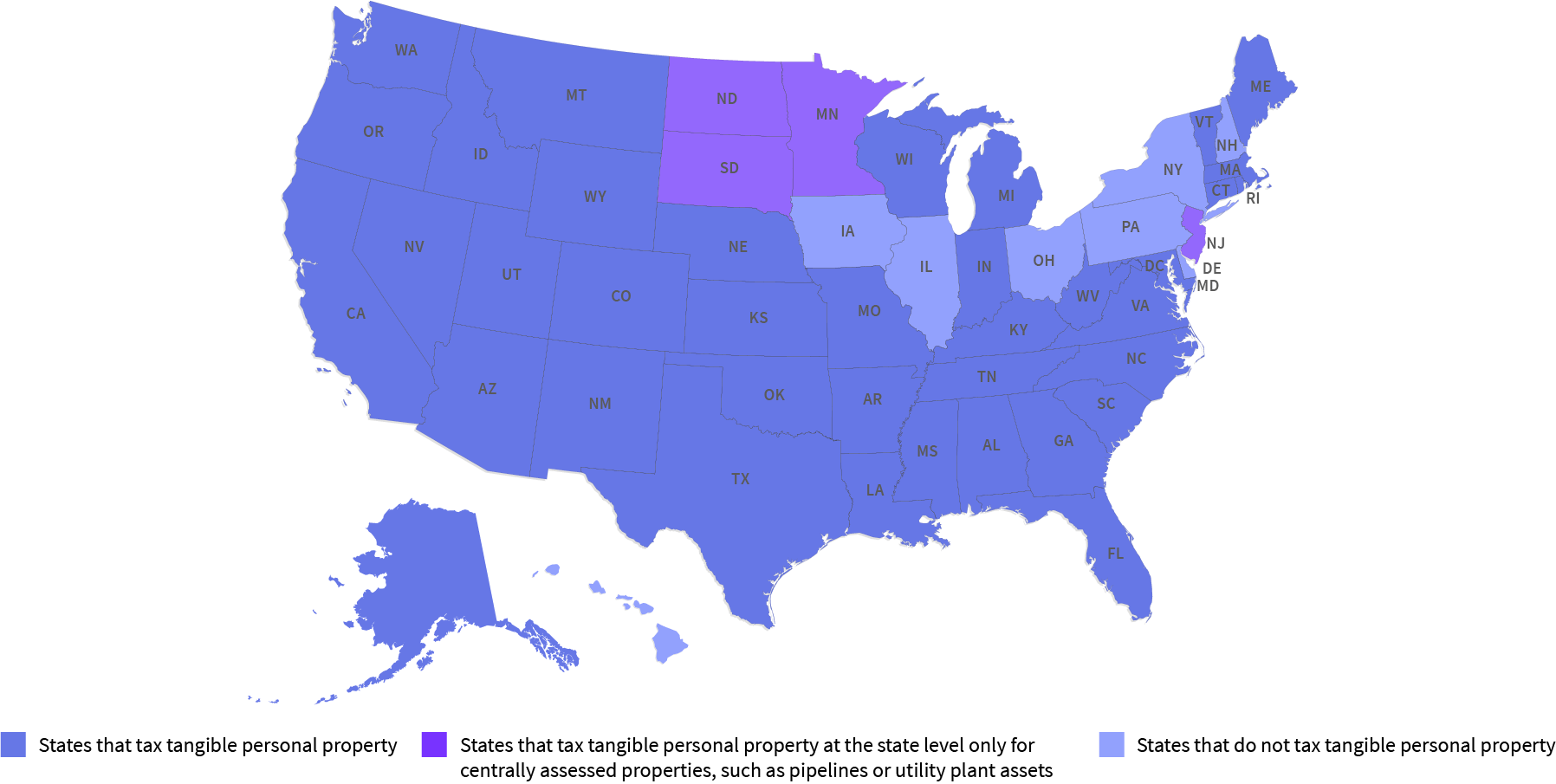

U S Property Taxes Comparing Residential And Commercial Rates Across States

Brookline Gives A Nod To Commercial Taxpayers With 2021 Tax Rates

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

Massachusetts Property Taxes By County 2022

Property Tax In The United States Wikipedia

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Welcome To The Thurston County Assessor S Office

Massachusetts Property Tax Rate Per Town Or City 2019

Real Estate Taxes Calculation Methodology And Trends Shenehon

Comparing The Cost Of Owning And Operating Commercial Real Estate Across The United States Corelogic

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty